Present Particulars For Abn 20 660 262 840 Abn Lookup

페이지 정보

작성자 Marlon 댓글 0건 조회 13회 작성일 24-12-06 19:05본문

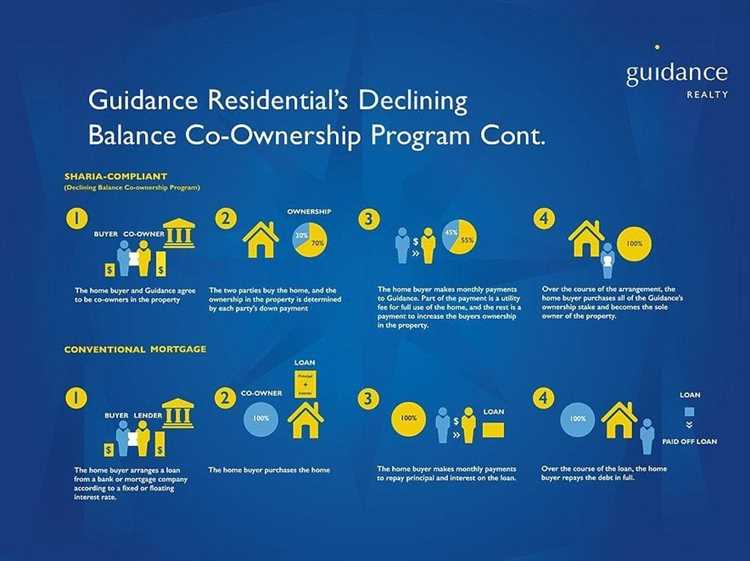

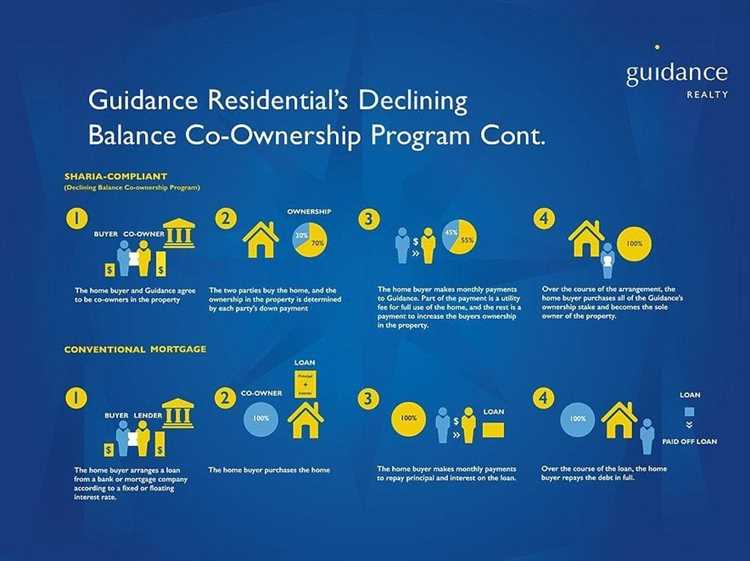

You might need to present that you’re good at managing cash and that you have saved money successfully up to now (which can embody money saved for your deposit). Just as with other kinds of residence loan, and in keeping with the precept of gharār, you will need to provide your lender with proof of your monetary circumstances earlier than any loan settlement could be made. The lender will must be persuaded that your income is enough to repay the loan over the time period you need. In a Murabaha transaction, the financial institution purchases the vehicle and sells it to the client at a profit margin agreed upon upfront, ensuring that the transaction remains interest-free. Islamic finance is a method to manage cash that retains within the ethical ideas of Islam.

In the context of car finance, Islamic finance makes use of methods similar to Murabaha (cost-plus financing) or Ijarah (leasing). Similarly, Ijarah entails the financial institution leasing the automobile to the client for a predetermined interval, with the choice to buy the vehicle at the finish of the lease term.

It supplies a stage of assurance for each the lender and the borrower, making certain the compensation of the loan in case of default. In right now's globalized world, it's essential to acknowledge and handle the distinctive monetary needs of Muslim communities.

This has been driven by a younger and fast-growing international inhabitants that extends beyond the core 1.9 billion Muslim shoppers to incorporate a wider international ethical shopper market, the analysis discovered. Financial inclusion refers to the access and utilization of monetary services by people and communities. Recently, in Sydney, Shaik stated two colleagues discovered Afiyah’s Islamic SMSF providing. "More families are actually exploring these options, leading to an increase in informed discussions and selections," he stated. Unfortunately, many Muslims all over the world nonetheless face significant barriers in phrases of accessing inclusive monetary providers that align w... While securing a car finance deal aligned with these ideas could present challenges, it is completely feasible. We’ve proven you these home loans that will assist you evaluate what’s out there in the Australian mortgage market, and make a more informed monetary decision. None of the Islamic financing companies at present offering shopper finance merchandise in Australia are licensed as absolutely fledged banks. However, as Islamic financing turns into more accessible, Shaik mentioned Australia is witnessing a big shift. Despite Australia’s rich Islamic history, many Muslim Australians have historically confronted difficulties in securing financing that complies with their religious ban on Riba (interest).

This equitable distribution of danger is crucial in maintaining the integrity of the monetary transaction based on shariah. If you have any type of concerns relating to where and the best ways to utilize Halal Car Loan Providers in Sydney, you could contact us at our page. That signifies that while they can offer house loans or tremendous, they can not take deposits from customers. Numerous Islamic monetary establishments in the UK cater specifically to Muslims looking for car finance, enabling them to take pleasure in the advantages of auto possession while maintaining adherence to their religious beliefs.

Halal car finance presents a variety of advantages that not only align with Islamic principles but additionally present moral and clear financial options for automobile ownership. The first step is to assemble all the necessary paperwork required by the monetary establishment. This means taking the time to analysis and perceive the options available to you.

Halal car finance presents a variety of advantages that not only align with Islamic principles but additionally present moral and clear financial options for automobile ownership. The first step is to assemble all the necessary paperwork required by the monetary establishment. This means taking the time to analysis and perceive the options available to you.

Hence, potential borrowers are required to show their commitment to these ideas through a transparent and moral utility process. A popular methodology in Islamic automobile financing is Ijarah, a lease-to-own association the place the bank buys the car and leases it to the shopper. This setup ensures that possession and danger are shared, and payments are structured as rent quite than interest, aligning with halal financing ideas. Understanding the Process of Halal Loan ApplicationWhen it comes to acquiring a halal loan, it's essential to understand the method concerned. These mortgages allow individuals to purchase real estate with out participating in interest-based transactions, as prohibited in Islamic finance. Another common approach is Murabaha, where the financier purchases the car and sells it to the customer at a profit margin agreed upon upfront, making certain transparency and ethical dealings. This type of financing aligns with Islamic rules of honest and transparent transactions, selling responsible homeownership throughout the Muslim group.

The objectives of IFIA is to be the voice and management of the Islamic banking, Insurance (Takaful), finance and investments business in Australia. By investing in asset-backed Halal mortgages, people can achieve homeownership whereas following ethical tips. The ideas many Muslims reside their lives by are generally known as the ‘Shari’ah’. So you might hear Islamic financial products & companies described as ‘Shari’ah-compliant’. Islamic car finance supplies a Sharia-compliant, moral resolution for acquiring vehicles.

In Islamic finance, asset-backed Halal mortgages are structured to make certain that the financing adheres to Shariah-compliant principles. When it involves looking for a Halal loan, it is essential to make an knowledgeable determination. Products in our comparability tables are sorted primarily based on varied factors, including product features, rates of interest, charges, popularity, and industrial preparations. Openness plays an important role in sustaining confidence in Halal financing. Our view is that these investments aren't defensive and carry vital dangers which is why we select not to use them and prefer more traditional development investments as a substitute even if the portfolios turn out to be extra risky.

When it comes to Halal loan agreements, the experience and steerage of Islamic students play an important position. These experts have a deep understanding of Shariah legislation and its rules, which type the muse of Halal financing. We strive to cover a broad range of products, providers, and services; nonetheless, we don't cowl the entire market. In a world where belief is paramount, being transparent and open about the practices and principles of Halal financing is important. Similarly, Ijarah involves the monetary establishment leasing the automobile to the shopper for a predetermined period, with the option to purchase the vehicle at the finish of the lease term. In a Murabaha transaction, the monetary establishment purchases the car and sells it to the shopper at a profit margin agreed upon upfront, ensuring that the transaction stays interest-free. Collateral acts as a type of security for lenders, offering assurance that the loan might be repaid.

In the context of car finance, Islamic finance utilizes strategies corresponding to Murabaha (cost-plus financing) or Ijarah (leasing). When it comes to securing Halal loans, understanding the collateral options out there is crucial. The construction of these mortgages entails the ownership of tangible property, such because the property itself, providing safety for the financing arrangement.

In the context of car finance, Islamic finance makes use of methods similar to Murabaha (cost-plus financing) or Ijarah (leasing). Similarly, Ijarah entails the financial institution leasing the automobile to the client for a predetermined interval, with the choice to buy the vehicle at the finish of the lease term.

It supplies a stage of assurance for each the lender and the borrower, making certain the compensation of the loan in case of default. In right now's globalized world, it's essential to acknowledge and handle the distinctive monetary needs of Muslim communities.

This has been driven by a younger and fast-growing international inhabitants that extends beyond the core 1.9 billion Muslim shoppers to incorporate a wider international ethical shopper market, the analysis discovered. Financial inclusion refers to the access and utilization of monetary services by people and communities. Recently, in Sydney, Shaik stated two colleagues discovered Afiyah’s Islamic SMSF providing. "More families are actually exploring these options, leading to an increase in informed discussions and selections," he stated. Unfortunately, many Muslims all over the world nonetheless face significant barriers in phrases of accessing inclusive monetary providers that align w... While securing a car finance deal aligned with these ideas could present challenges, it is completely feasible. We’ve proven you these home loans that will assist you evaluate what’s out there in the Australian mortgage market, and make a more informed monetary decision. None of the Islamic financing companies at present offering shopper finance merchandise in Australia are licensed as absolutely fledged banks. However, as Islamic financing turns into more accessible, Shaik mentioned Australia is witnessing a big shift. Despite Australia’s rich Islamic history, many Muslim Australians have historically confronted difficulties in securing financing that complies with their religious ban on Riba (interest).

This equitable distribution of danger is crucial in maintaining the integrity of the monetary transaction based on shariah. If you have any type of concerns relating to where and the best ways to utilize Halal Car Loan Providers in Sydney, you could contact us at our page. That signifies that while they can offer house loans or tremendous, they can not take deposits from customers. Numerous Islamic monetary establishments in the UK cater specifically to Muslims looking for car finance, enabling them to take pleasure in the advantages of auto possession while maintaining adherence to their religious beliefs.

Halal car finance presents a variety of advantages that not only align with Islamic principles but additionally present moral and clear financial options for automobile ownership. The first step is to assemble all the necessary paperwork required by the monetary establishment. This means taking the time to analysis and perceive the options available to you.

Halal car finance presents a variety of advantages that not only align with Islamic principles but additionally present moral and clear financial options for automobile ownership. The first step is to assemble all the necessary paperwork required by the monetary establishment. This means taking the time to analysis and perceive the options available to you.Hence, potential borrowers are required to show their commitment to these ideas through a transparent and moral utility process. A popular methodology in Islamic automobile financing is Ijarah, a lease-to-own association the place the bank buys the car and leases it to the shopper. This setup ensures that possession and danger are shared, and payments are structured as rent quite than interest, aligning with halal financing ideas. Understanding the Process of Halal Loan ApplicationWhen it comes to acquiring a halal loan, it's essential to understand the method concerned. These mortgages allow individuals to purchase real estate with out participating in interest-based transactions, as prohibited in Islamic finance. Another common approach is Murabaha, where the financier purchases the car and sells it to the customer at a profit margin agreed upon upfront, making certain transparency and ethical dealings. This type of financing aligns with Islamic rules of honest and transparent transactions, selling responsible homeownership throughout the Muslim group.

The objectives of IFIA is to be the voice and management of the Islamic banking, Insurance (Takaful), finance and investments business in Australia. By investing in asset-backed Halal mortgages, people can achieve homeownership whereas following ethical tips. The ideas many Muslims reside their lives by are generally known as the ‘Shari’ah’. So you might hear Islamic financial products & companies described as ‘Shari’ah-compliant’. Islamic car finance supplies a Sharia-compliant, moral resolution for acquiring vehicles.

In Islamic finance, asset-backed Halal mortgages are structured to make certain that the financing adheres to Shariah-compliant principles. When it involves looking for a Halal loan, it is essential to make an knowledgeable determination. Products in our comparability tables are sorted primarily based on varied factors, including product features, rates of interest, charges, popularity, and industrial preparations. Openness plays an important role in sustaining confidence in Halal financing. Our view is that these investments aren't defensive and carry vital dangers which is why we select not to use them and prefer more traditional development investments as a substitute even if the portfolios turn out to be extra risky.

When it comes to Halal loan agreements, the experience and steerage of Islamic students play an important position. These experts have a deep understanding of Shariah legislation and its rules, which type the muse of Halal financing. We strive to cover a broad range of products, providers, and services; nonetheless, we don't cowl the entire market. In a world where belief is paramount, being transparent and open about the practices and principles of Halal financing is important. Similarly, Ijarah involves the monetary establishment leasing the automobile to the shopper for a predetermined period, with the option to purchase the vehicle at the finish of the lease term. In a Murabaha transaction, the monetary establishment purchases the car and sells it to the shopper at a profit margin agreed upon upfront, ensuring that the transaction stays interest-free. Collateral acts as a type of security for lenders, offering assurance that the loan might be repaid.

In the context of car finance, Islamic finance utilizes strategies corresponding to Murabaha (cost-plus financing) or Ijarah (leasing). When it comes to securing Halal loans, understanding the collateral options out there is crucial. The construction of these mortgages entails the ownership of tangible property, such because the property itself, providing safety for the financing arrangement.

댓글목록

등록된 댓글이 없습니다.